3.1.8 E-File State Return

Only available for W-2

formsets

If you have state wages in a state or states that accept electronic filings, Year-End Forms will prepare the E-File for you, along with the instructions you need to E-File the form yourself.

It is important to first review all warnings and errors with your forms. If any exist, a link to the warnings and errors report is provided on the first page of the E-File process. It is important that you remove as many warnings as possible before you complete the wizard.

To E-File, access

the State E-File Wizard from the task-driven homepage checklist. The State

E-Filing main page allows you to view each state for which you have wages. If

you have already filed for that state, you will see a ‘View History’ link that

provides further details about the file submitted. If the state wages are ready

to file, you are provided a ‘File Now’ link, which will launch the E-File

Wizard.

3.1.8.1

State

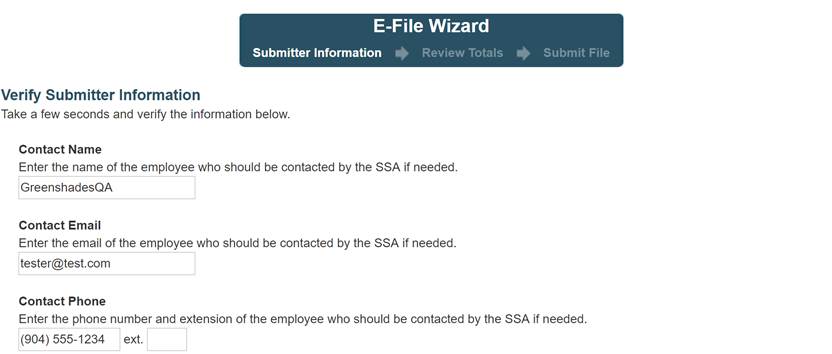

E-File Wizard: Submitter Information

The first step of the State E-File Wizard requires you to verify the Contact Name, Email, and Phone for the submission.

3.1.8.2

State

E-File Wizard: Review Totals

The

‘Review Totals’ step will calculate the totals and present them for your

review. If errors are present, Year-End Forms will require that you correct

these errors before you can submit this filing. When you have reviewed and

approved the totals, click ‘Continue’ to continue to submitting.

3.1.8.3

Downloading

State E-File

You may download the E-File and the details file by clicking the ‘View History’ link next to the State.

On the ‘E-File History’ page, use the download links to obtain the State E-File and Details File.

For additional support please contact us.

(888) 255-3815 ext.1